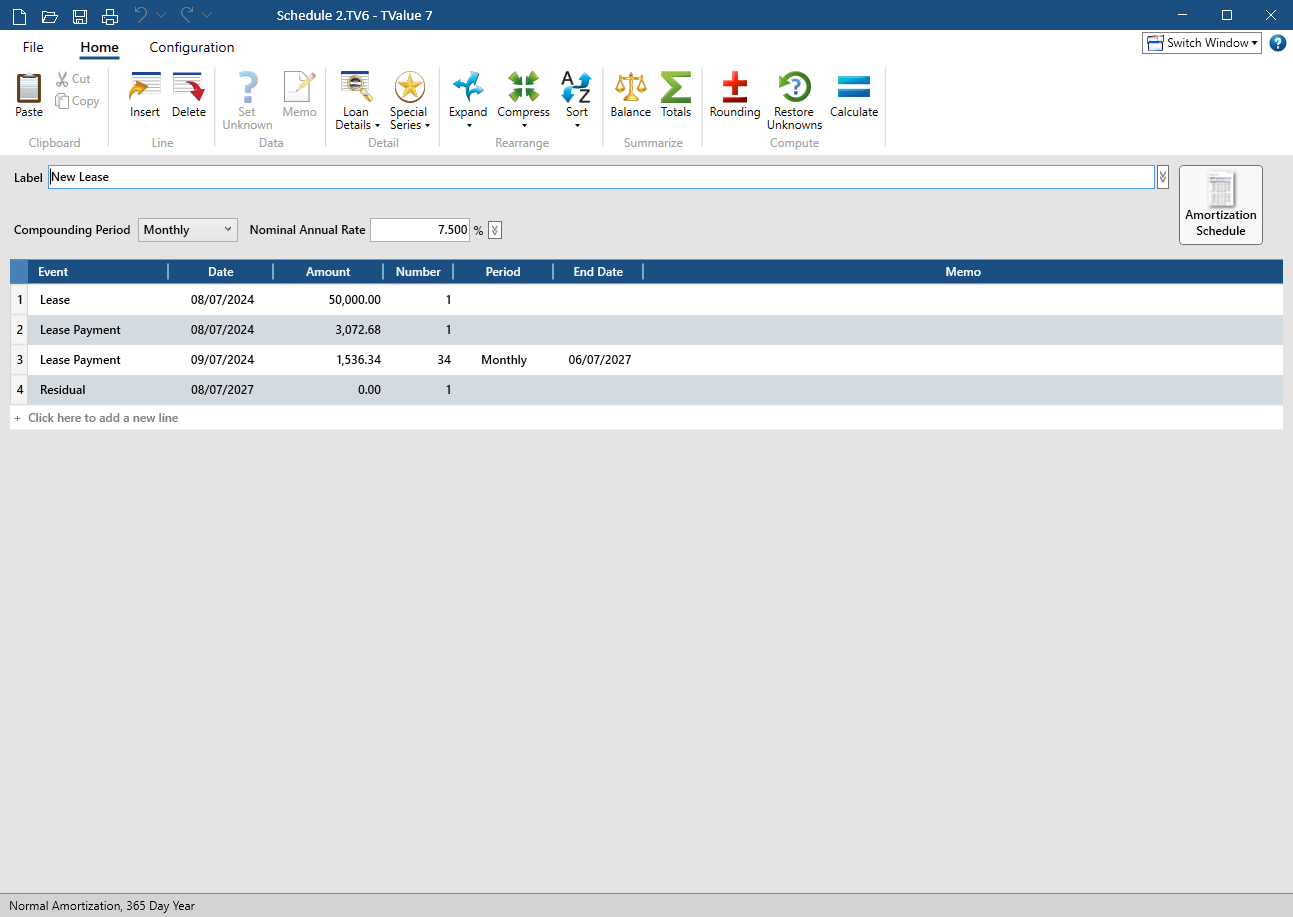

Click the Lease button from the guide screen. The Lease dialog window is displayed as shown below with its standard defaults. This guide's assumptions are listed in the box above the input fields.

Lease dialog input fields

Note: Use [Tab] to move from field to field or click within each field.

• Start date: The start date defaults to the current date. Click in the Start date field and enter a date or click the Calendar button and select the desired date. (See Date shortcuts.)

• Lease amount: Type the dollar amount of the lease. For this example 50K (for 50,000.00) was entered. (See Amount shortcuts.)

• Advanced payments: The drop-down list has 3 options: 0 (Arrears), 1 Advanced Payment, or 2 Advanced Payments. You can choose an option from the drop-down list or type 0, 1, or 2 in the Advanced payments field. For this example [Tab] (for default of 2 Advanced Payments) was entered as the lease calls for 2 upfront/advance payments to be made when the lease is signed. An advanced payment effectively reduces the amount of the lease which lowers the payment amounts.

• Lease term (in years): The drop-down list has 10 options: 1 year to 10 years. You can choose an option from the drop-down list or type any number between 1 and 10 in the Lease term field. For this example [Tab] (for default of 3 years) was entered.

• Residual amount: Type the dollar amount of the residual. For this example 5K (for 5,000.00) was entered. The monthly payments of a lease are based on the difference between the amount of the lease and the amount of the residual.

• Interest rate: This is a percent field where the interest rate of the lease should be entered. For this example 7.5 was entered (for 7.5%).

• Create: Builds the cash flow based on all entered data.

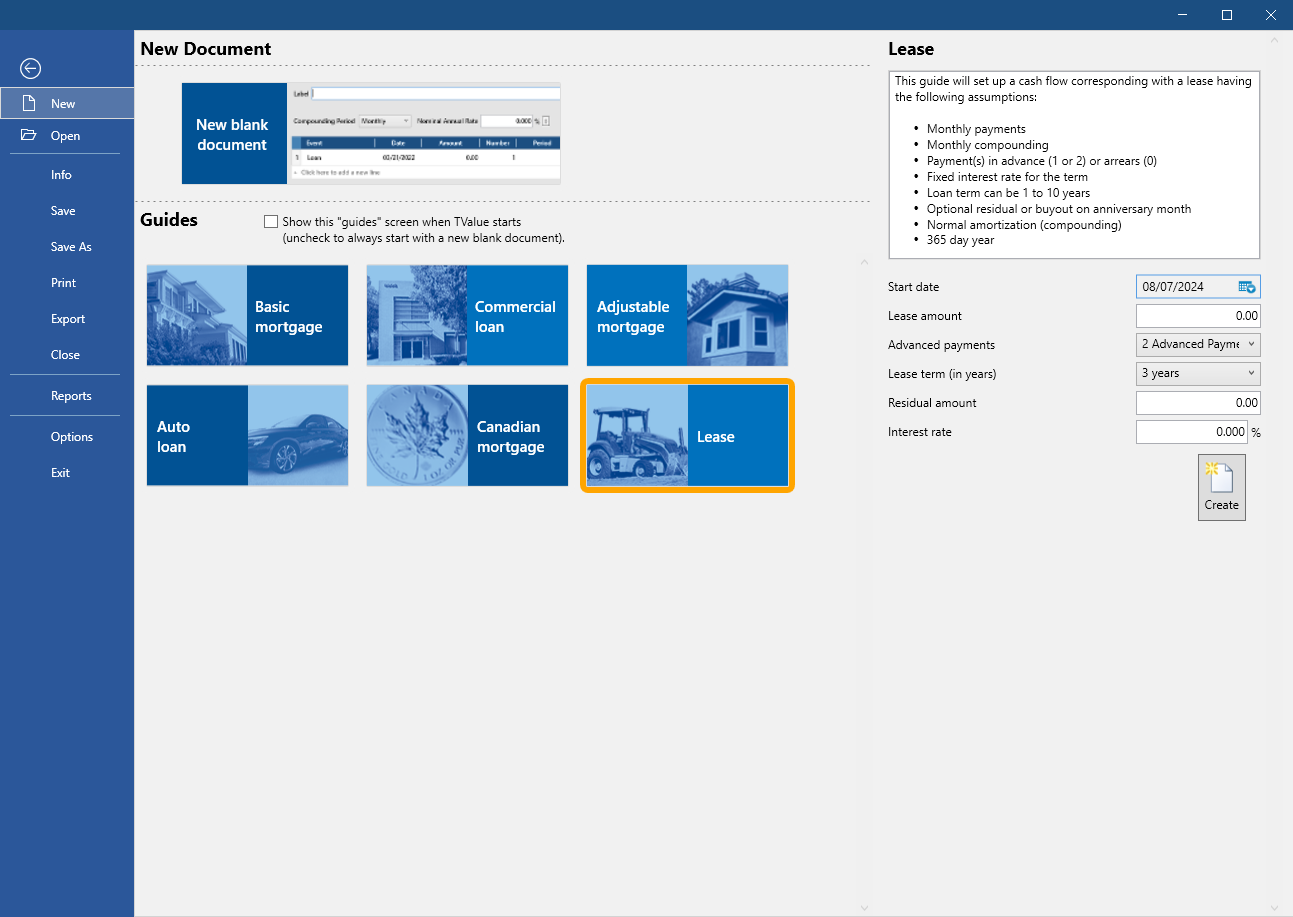

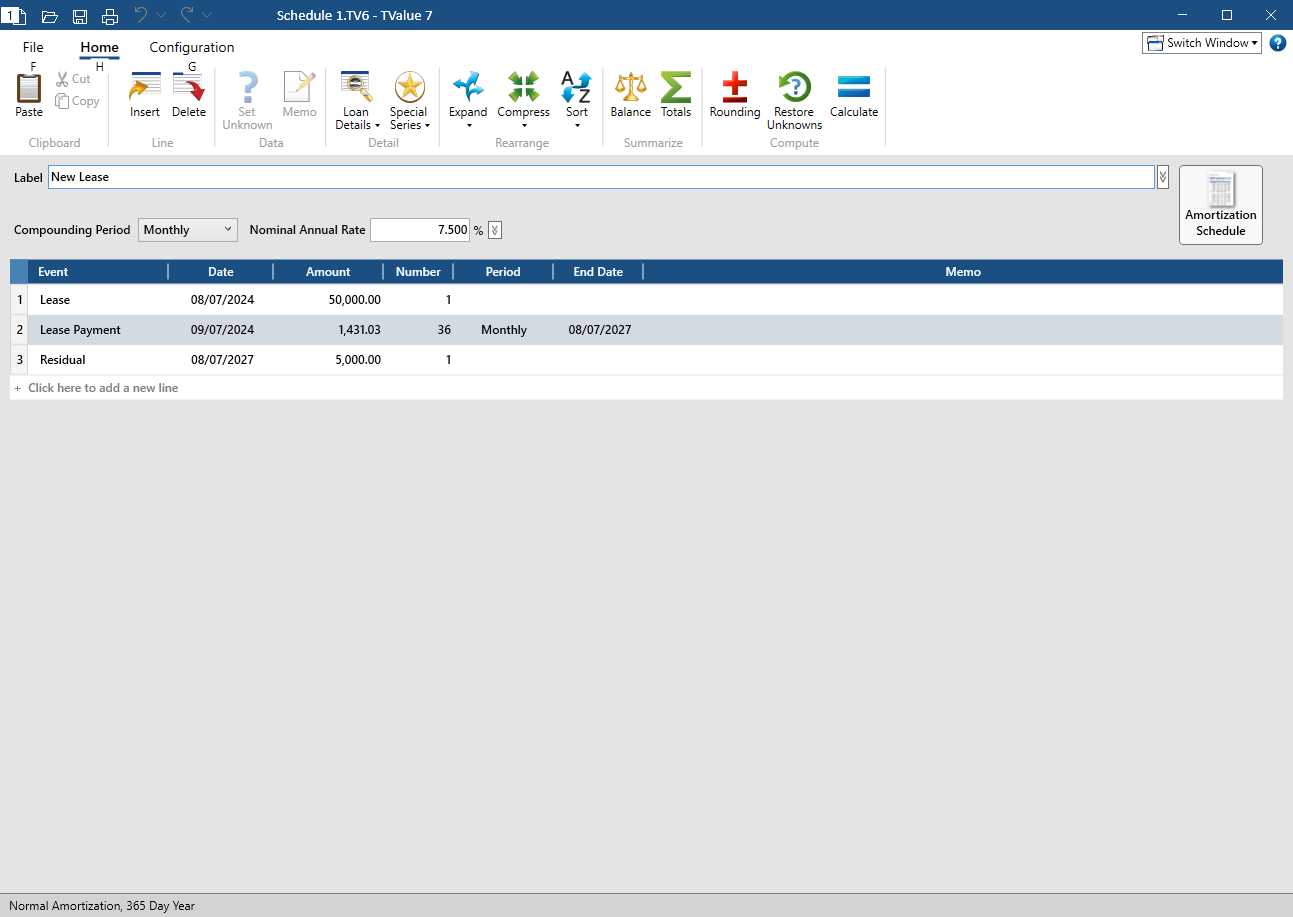

The pre-populated Cash Flow Data window should now appear as shown below. The cash flow can be further adjusted to fit your specific lease scenario.

Cash Flow Data fields

• Label field includes the name of the guide used. (See Edit the Label field.)

• Compounding Period is set to Monthly per this guide's assumptions.

• Nominal Annual Rate is set to the Interest rate of 7.5%.

• The calculation settings per this guide's assumptions (Normal amortization and a 365 day year) are displayed at the bottom left. You can click on the displayed settings to quickly access the Calculations group on the Configuration ribbon where you can change these settings.

Cash Flow Matrix fields

• Start date: The Date in the Lease Event (line 1).

• Lease amount: The Amount - 50,000.00 - in the Lease Event (line 1).

• Advanced payments: The Date in the first Lease Payment Event (line 2) is the same as the Date in the Lease Event (line 1) and the Amount is 2 times (2 Advanced Payments) the Amount in the second Lease Payment Event (line 3).

• Lease term (in years): The Number field in the second Lease Payment Event (line 3) plus the 2 Advanced Payments (line 2) = 36 (3 years).

• Residual amount: The Date of the Residual Event (line 4) is 3 years after the Start date of the Lease and the Amount field shows the 5,000.00 entered

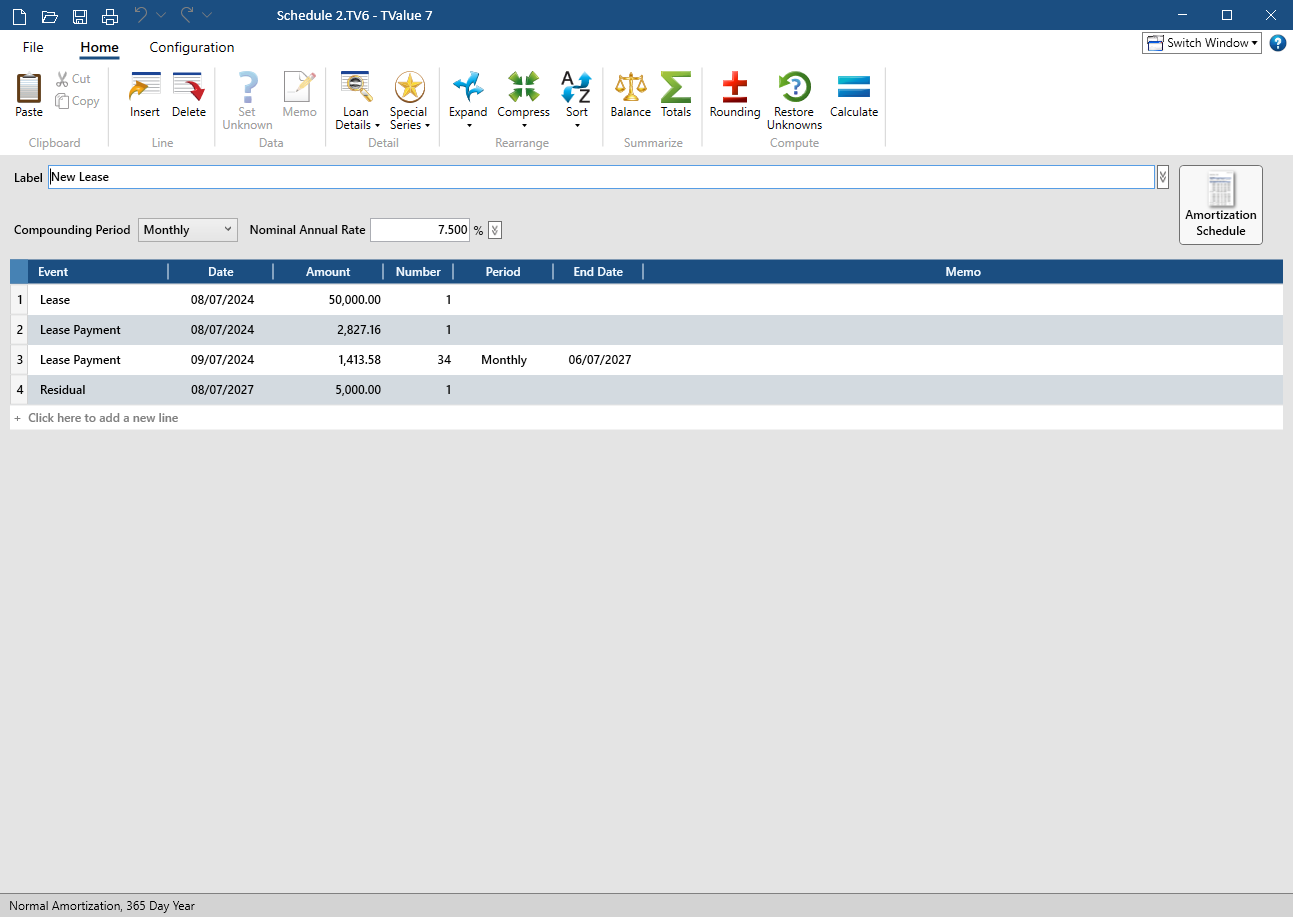

1 Advanced payment example

Below is the pre-populated Cash Flow Data window with the same Lease dialog inputs as above BUT with 1 Advanced Payment selected in the Advanced Payments field. The cash flow can be further adjusted to fit your specific Lease with 1 Advanced Payment scenario.

Note: there is only one Lease Payment Event (line 2) with a Date that is the same as the Start date (for the 1 Advanced Payment) with all 36 (Lease term of 3 years) payments and the Lease Payment Amount is higher than the previous example as only 1 upfront payment was made.

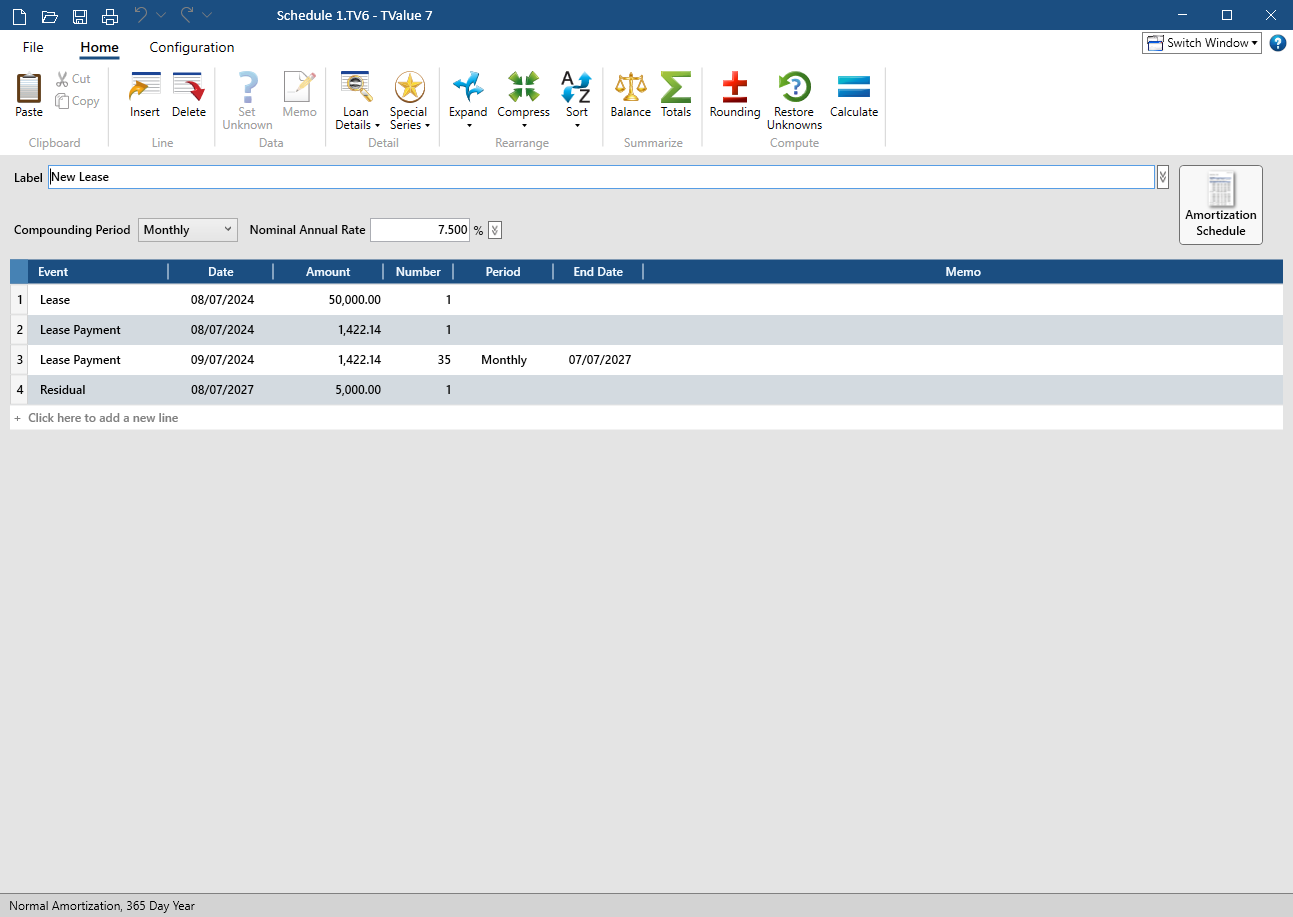

0 (Arrears) Advanced payments example

Below is the pre-populated Cash Flow Data window with the same Lease dialog inputs as above BUT with 0 (Arrears) selected in the Advanced Payments field. The cash flow can be further adjusted to fit your specific Lease with 0 Advanced Payments scenario.

Note: there is only one Lease Payment Event (line 2) with a Date that is one month (per this guide's assumptions) from the Start date with all 36 (Lease term of 3 years) payments and the Lease Payment Amount is higher than the previous examples as no upfront payments were made.

No Residual amount example

Below is the pre-populated Cash Flow Data window with the same Lease dialog inputs as the first example BUT with no Residual amount. The cash flow can be further adjusted to fit your specific Lease with 0 Residual amount scenario.